Selling your property in India while living abroad might sound complex, but with the right roadmap, it can be a smooth and rewarding journey.

From capital gains tax to FEMA rules and repatriation, this guide breaks down everything NRIs must know to sell property in India legally, tax-efficiently, and confidently.

1️⃣ Capital Gains Tax: What Every NRI Must Know

Understanding capital gains tax is step one when planning your sale.

🔹 Short-Term Capital Gains (STCG):

Property held < 24 months

Taxed at your slab rate

Buyer deducts 30% TDS

🔹 Long-Term Capital Gains (LTCG):

Property held > 24 months

Taxed at 20% with indexation

Buyer deducts 20% TDS

📌 Inherited Property?

The holding period is calculated from when the original owner bought it. You can use indexation from April 1, 2001 (or purchase date, whichever is later).

💡 Note: Surcharge and 4% cess are applicable on higher-value transactions.

2️⃣ TDS (Tax Deducted at Source): Don’t Ignore This!

As an NRI seller, TDS is deducted by the buyer before payment:

✔️ 30% TDS on STCG

✔️ 20% TDS on LTCG

✅ Provide your PAN – or TDS can go even higher

✅ Buyer must file Form 27Q and issue Form 16B to you

✅ You can apply for a Lower/Nil TDS Certificate (Sec 197) if actual tax liability is less — plan at least 30-40 days before sale

3️⃣ FEMA Guidelines: Selling Property the Right Way

Foreign Exchange Management Act (FEMA) compliance is non-negotiable:

🏡 You can sell property to:

Resident Indians

NRIs or OCIs (but not agricultural land/farmhouses)

📄 All transactions must go through authorized banking channels

📜 If abroad, issue a Power of Attorney (PoA):

Must be notarized and attested by the Indian Embassy

Stamped at Sub-Registrar in India

4️⃣ Repatriation: How to Bring Your Sale Proceeds Abroad

After the sale, funds typically go to your NRO account. Repatriation to your resident country involves:

💰 USD 1 Million/year repatriation limit (across all NRO remittances)

🧾 File Form 15CA and obtain Form 15CB (if amount > ₹5 lakh)

📌 Over USD 1M or inherited property? You may need RBI approval

5️⃣How to Save Tax: Exemptions for Smart NRIs

🏡 Section 54 – Reinvest in Property

Buy/construct another residential property

Up to 2 properties if gains ≤ ₹2 Cr

Timeline: Buy within 2 years or construct in 3 Years

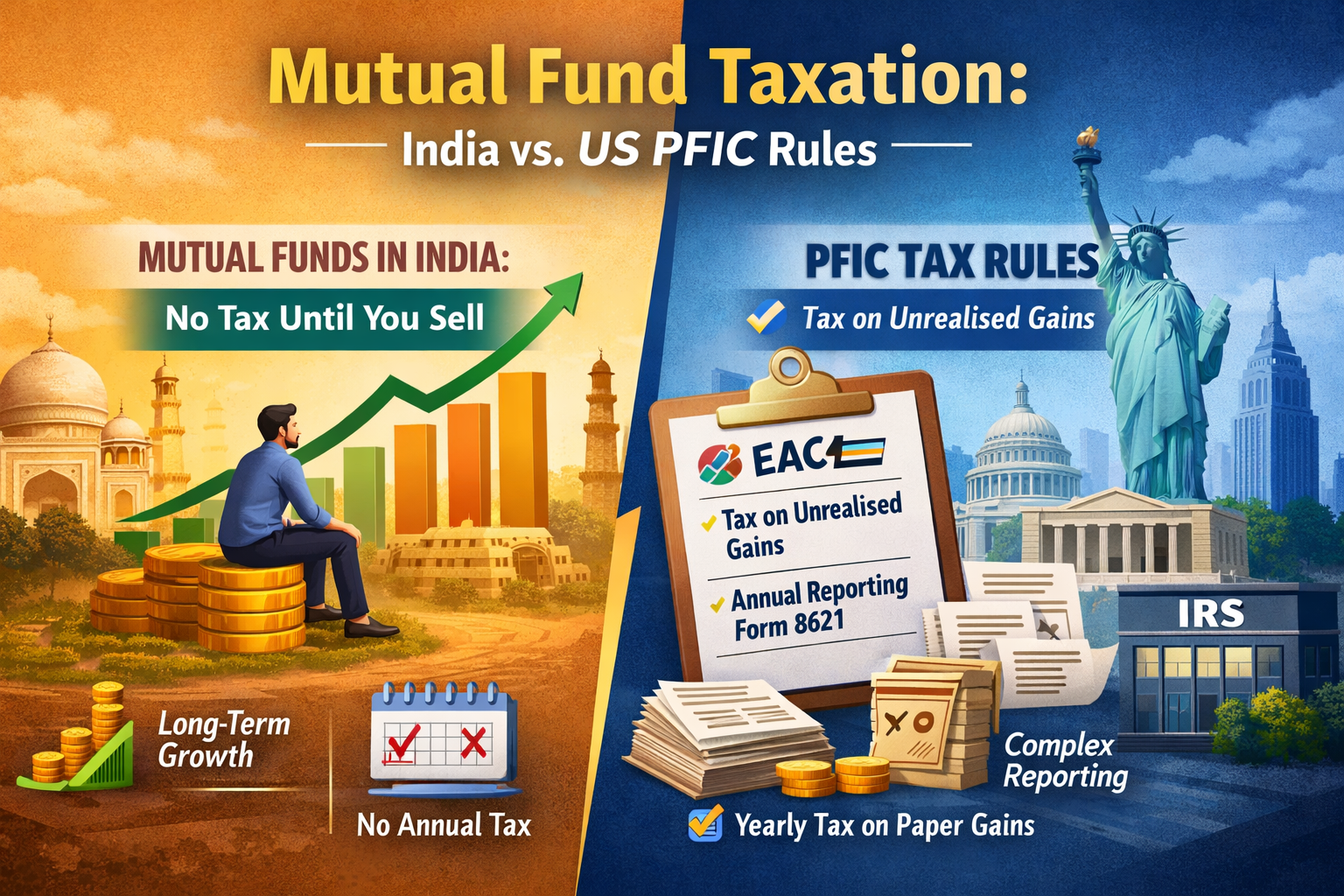

🌐 DTAA Benefits – Avoid Double Tax

Claim credit in your country of residence

Get a Tax Residency Certificate (TRC) and file Form 10F in India

6️⃣ Final Tips: Process & Professional Help

✔️ Get your property valued

✔️ Market it effectively and verify the buyer

✔️ Use a property lawyer & NRI-specialized CA

✔️ Understand stamp duty & registration

✔️ Don’t skip legal due diligence

✅ In Conclusion

Selling property in India as an NRI is a high-stakes financial and legal event. But with the right compliance, expert help, and early planning, it doesn’t have to be stressful.

✨ Maximize your returns, minimize tax, and repatriate your funds with peace of mind.

💼 Team Wealth By Rule – The House of Financial Experts

📞 Call Us: 99049 33311

🌐 Visit: www.wealthbyrule.com

🧾 India’s Trusted Partner for NRI Taxation, Compliance & Wealth Guidance