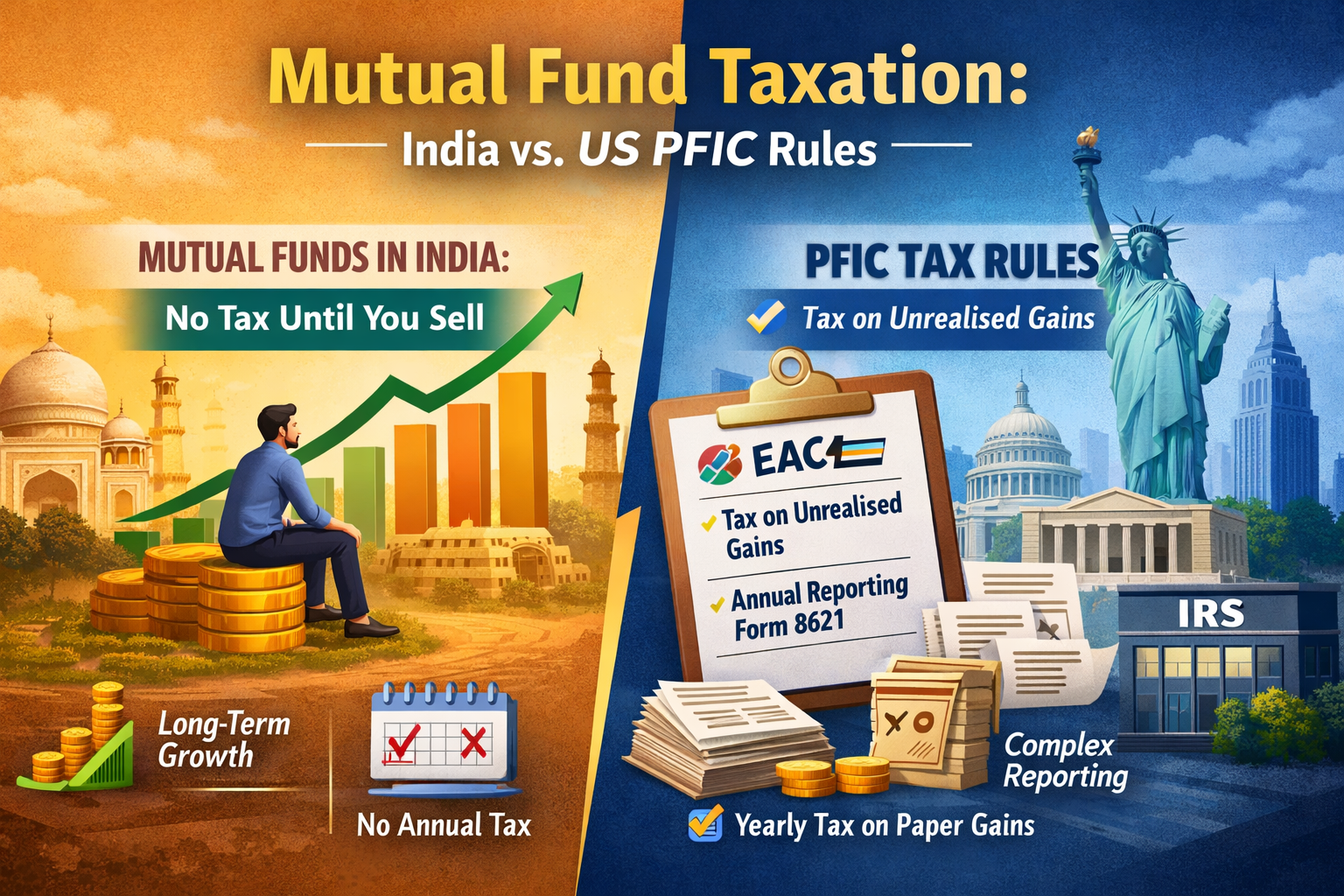

Non-Resident Indians (NRIs) investing in Indian mutual funds often face confusion around taxation—especially when it comes to capital gains. The good news? The Double Taxation Avoidance Agreement (DTAA) between India and various countries may offer relief from being taxed twice on the same income.

In this blog, we break down the taxability of capital gains on mutual funds for NRIs based on DTAA with key countries.

📌 What is DTAA?

The Double Taxation Avoidance Agreement (DTAA) is a treaty signed between India and other countries to ensure that an individual is not taxed twice on the same income—in both the country of residence and the source country (India).

When it comes to capital gains from mutual funds, DTAA plays a crucial role in determining where the tax liability lies.

🧮 Mutual Fund Capital Gains: Tax Treatment for NRIs under DTAA

Below is a summary of how mutual fund capital gains are taxed in India for residents of select countries:

| Country | Relevant Article | Taxability in India |

|---|---|---|

| United States | Article 13 | Taxable in India |

| UAE | Article 13(5) | Not Taxable in India |

| United Kingdom | Article 14 | Taxable in India |

| Singapore | Article 13(5) | Not Taxable in India (subject to Limitation of Benefits) |

| Saudi Arabia | Article 13(6) | Not Taxable in India |

| Kuwait | Article 13(6) | Not Taxable in India |

| Oman | Article 15(6) | Not Taxable in India |

| Qatar | Article 13(6) | Not Taxable in India |

| Hong Kong | Article 14 | Taxable in India |

| Australia | Article 13 | Taxable in India |

| Malaysia | Article 14(6) | Not Taxable in India |

| Canada | Article 13 | Taxable in India & Canada (Tax credit available) |

| Germany | Article 13 | Not Taxable in India |

| Italy | Article 14(6) | Not Taxable in India |

| Philippines | Article 14(5) | Not Taxable in India |

| Nepal | Article 13(6) | Not Taxable in India |

✅ Documents Required to Claim DTAA Benefit

To avail the DTAA benefits on mutual fund capital gains:

-

Tax Residency Certificate (TRC) from the country of residence

-

Form 10F filed with Indian tax authorities

-

PAN and other investment documents

-

Satisfy Limitation of Benefits (LOB) clause, if applicable

🧠 Pro Tip:

Even if your gains are not taxable in India under the DTAA, you must file a return in India to claim exemption and avoid unnecessary TDS deductions. Also, check if your country of residence allows foreign tax credits to offset any Indian tax paid.

🏁 Final Thoughts

Understanding DTAA provisions is essential for smart and compliant investing. NRIs can reduce or eliminate double taxation on capital gains by properly utilizing these treaty benefits.

🧾 Need Expert Help? Contact WealthByRule

At WealthByRule, our team of Experts specializes in NRI taxation, property sale compliance, and Form 15CA/CB certification.

💼 Team Wealth By Rule – The House of Financial Experts

📞 Call Us: 99049 33311

🌐 Visit: www.wealthbyrule.com

🧾 India’s Trusted Partner for NRI Taxation, Compliance & Wealth Guidance

Disclaimer: This blog is for educational purposes only. Always consult a professional tax advisor before making investment or compliance decisions.