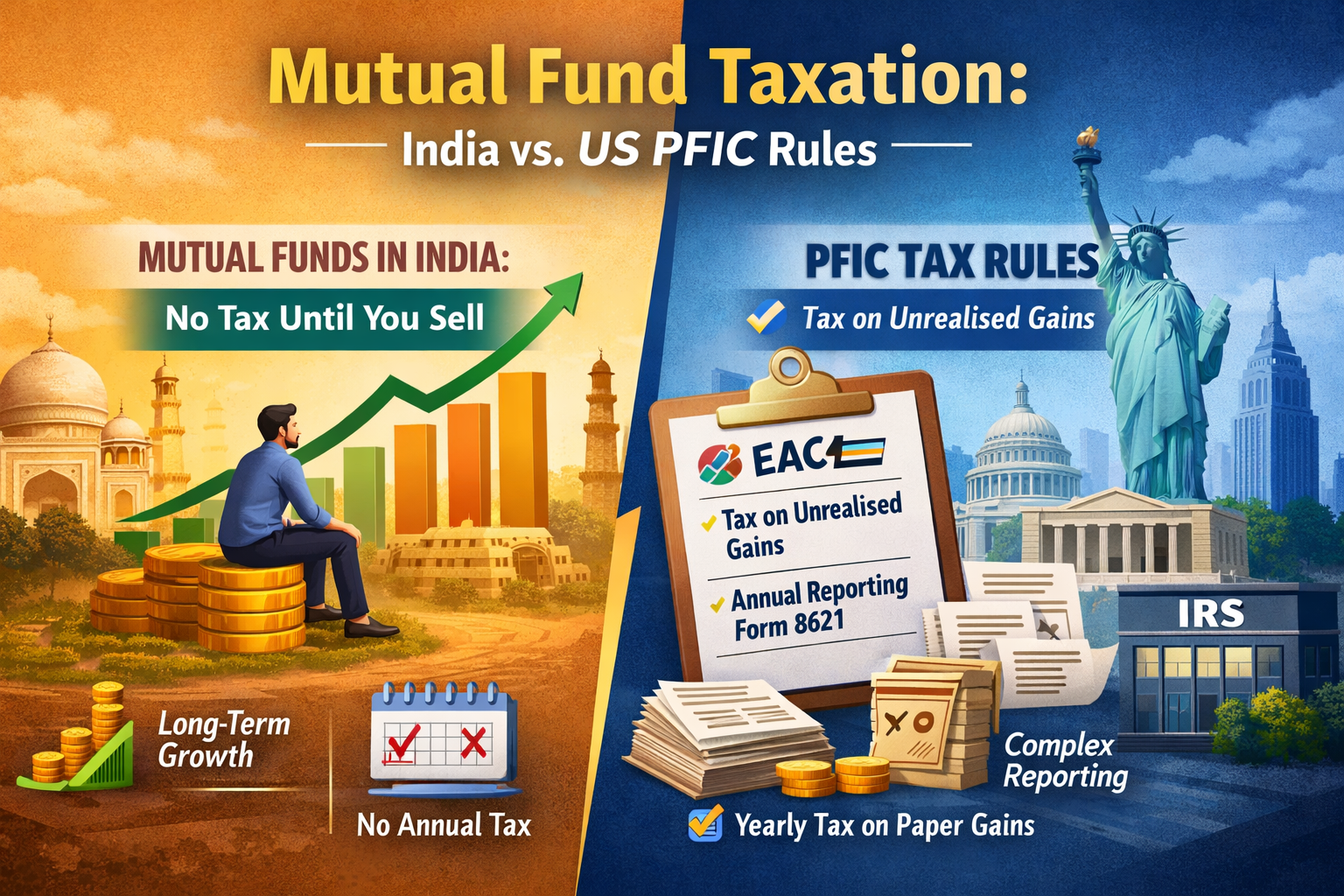

Mutual Fund Taxation in India: Tax Only on Realized Gains

In India, mutual fund investments are taxed on a realisation basis.

What this means:

There is no tax when the NAV (Net Asset Value) of your mutual fund increases

Tax arises only when you sell (redeem) your mutual fund units

Switching between schemes is also treated as redemption

Dividends are taxable only when received

₹ Unrealised or “paper” gains are completely tax-free until you actually exit the investment.

Example:

Investment amount: ₹5,00,000

Market value after growth: ₹7,00,000

Tax payable: Nil (as long as you don’t redeem)

Tax applies only on ₹2,00,000 when the units are sold

This system allows investors to benefit fully from long-term compounding without annual tax leakage.

US PFIC Rules: Tax Even Without Selling

The United States follows a very different approach for foreign pooled investments.

Under US tax law, foreign mutual funds and ETFs are often classified as PFICs (Passive Foreign Investment Companies) by the Internal Revenue Service.

Key features of PFIC taxation:

Investors may be taxed even without selling the investment

Unrealised (notional) gains can be allocated year-by-year

Interest penalties apply for deferred tax

Mandatory annual reporting (Form 8621)

Compliance is complex and costly

⚠️ The intention behind PFIC rules is to prevent US taxpayers from deferring taxes by investing outside the US financial system.

India vs US PFIC: A Simple Comparison

Parameter India – Mutual Funds | US – PFIC Rules

Tax on NAV increase ❌ No ⚠️ Yes (possible)

Tax without selling ❌ No ✔️ Yes

Unrealised gains taxed ❌ Never ⚠️ Often

Reporting burden Low Very high

Investor friendliness High Low

Why India’s Approach Is Investor-Friendly

India follows the principle of “income is taxable only when realised”.

This ensures:

Better long-term wealth creation

No forced liquidation for tax payments

Simpler compliance for retail investors

Encouragement of long-term investing discipline

There is no concept of taxing notional gains under Indian income-tax law.

Key Takeaway for Investors

In India, mutual fund gains are taxed only when you actually sell the investment. In contrast, US PFIC rules may tax investors on unrealised gains every year—even without redemption.